This is where the magic happens a curve that combines the total revenue and total cost lines. Additionally, when considering factors like cost of living comparison by city, it provides a comprehensive view of the relationship between revenue and costs. Therefore, it helps businesses analyze the impact of varying production levels on their financial performance. CVP analysis can be useful for companies when making short-term business decisions. Running a CVP analysis involves using several equations for price, cost, and other variables; these equations are plotted on a graph.

Break-Even Dollars = Fixed Costs/Contribution Margin Ratio

- The break-even point is reached when total costs and total revenues are equal, generating no gain or loss (Operating Income of $0).

- The variable cost is the cost of making the sandwich (the bread, mustard, and pickles).

- The store can make informed decisions about pricing, product mix, and resource allocation by understanding the fixed costs.

- Thus ABC limited the need to sell units of electric fans to break even at the current cost structure.

- Another assumption is all changes in expenses occur because of changes in activity level.

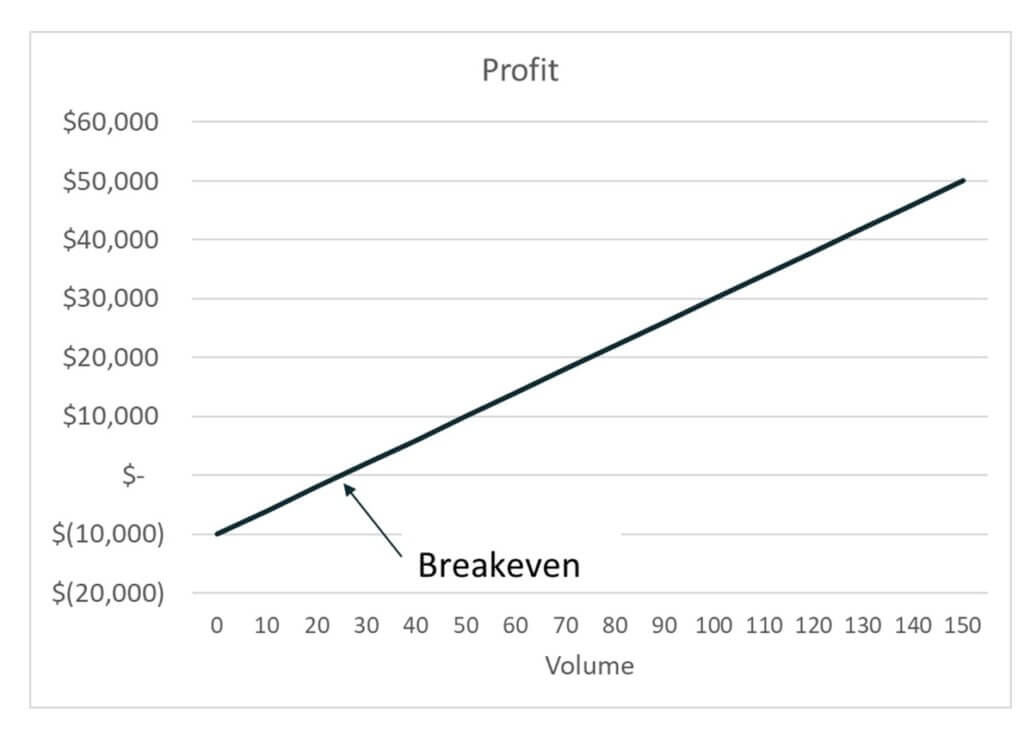

These costs are incurred by a company regardless of whether it produces or sells anything. Examples of fixed costs include rent, salaries, property taxes, and insurance premiums. The company has fixed costs of $10,000 per month, variable costs of $5 per widget, and sells widgets using the price to earnings ratio and peg to assess a stock for $10 each. The equation above demonstrates 100 percent of income ($100) minus $60 from variable costs equals $40 contribution margin. The equation below demonstrates revenues doubling to $200 and deducting fixed costs of $120, that results in $80 contribution margin.

How confident are you in your long term financial plan?

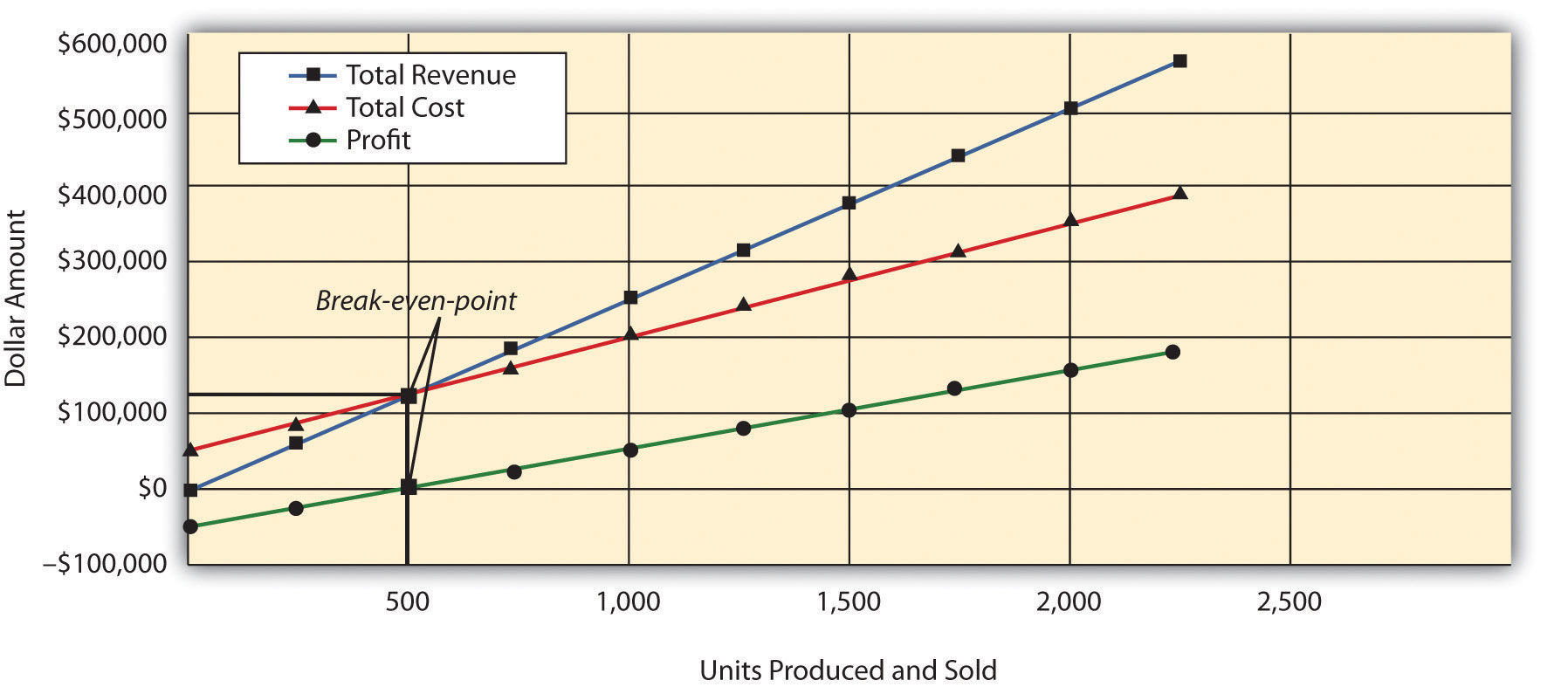

Among other things, break-even and what-if analyses are carried out for a variety of scenarios to estimate the effects on profits of short-term changes in cost, volume, and selling price. Companies use cost-volume-profit (CVP)analysis (also called break-even analysis) to determinewhat affects changes in their selling prices, costs, and/or volumewill have on profits in the short run. A careful and accuratecost-volume-profit (CVP) analysis requires knowledge of costs andtheir fixed or variable behavior as volume changes. The graph above shows the relationship between total revenue and total costs. The area between the two lines below the break-even point represents losses and the area above the breake-even point shows the volume of total profit.

Cost-Volume-Profit (CVP) Analysis and Contribution Margin

As you can see from the example chart above, the fixed production costs are represented by the solid gray line and are constant across all levels of production. Identifying the break-even point’ the level at which revenue equals total costs’ helps you strategize to enhance profitability. The break-even point is important because it gives businesses a clear understanding of the sales volume they need to achieve to cover their costs and profit. It can also help businesses to make informed decisions about pricing, product mix, and resource allocation. If the store sells $10,000 worth of merchandise in a month, the contribution margin would be zero, and it could not cover its fixed costs.

The store can make informed decisions about pricing, product mix, and resource allocation by understanding the fixed costs. The store can also use fixed costs for budgeting and forecasting to ensure that it can cover its expenses and generate a profit. Cost volume profit analysis is a financial planning tool frequently used to assess the viability of short-term strategies.

What are the Advantages and Limitations of Cost Volume Profit Charts?

Additionally, the user-friendly interface ensures accessibility for professionals across diverse sectors, fostering informed decision-making. ChartExpo charts are available both in Google Sheets and Microsoft Excel. Please use the following CTA’s to install the tool of your choice and create beautiful visualizations in a few clicks in your favorite tool.

The revenue may be expressed in number of units sold or in dollar amounts. The table shows the percent of income for sales, contribution margin, and operating income are observed as totals, after variable and fixed cost deductions. There are some limitations related to CVP analysis that you need to keep in mind. This type of analysis relies on a clear distinction being made between fixed and variable costs.

It is a subset of CVP analysis focused on finding a situation where total revenue equals total costs, resulting in zero profit or loss. However, we will likely need to enter a sales dollar figure (rather than the number of units sold) on the register. This involves dividing the fixed costs by the contribution margin ratio. It involves identifying fixed and variable costs, determining the break-even point, and analyzing how changes in volume impact profits.

The total revenue line represents the cumulative income an organization generates at various sales volume levels. It typically slopes upward linearly, reflecting the direct relationship between sales and revenue. Break-even points, where total costs equal total revenue, are also identified. Beyond this point, it illustrates profit zones, where revenue surpasses costs, and loss zones, where costs exceed revenue. Cost-volume-profit (CVP) analysis is a technique used to determine the effects of changes in an organization’s sales volume on its costs, revenue, and profit. CVP stands for cost-volume-profit – three of the essential cornerstones of business.